RMC AI Advisor for Finance

RMC AI Advisor for Finance

Overview

The RMC AI Advisor for Finance is powered by a foundation model, a large-scale AI system that can be fine-tuned to handle diverse financial tasks. These foundation models serve as the backbone of the AI's ability to understand vast and complex datasets, offering precise, data-driven insights.

Here's how the foundation model context enhances RMC AI Advisor for Finance:

- Pre-trained Knowledge: The foundation model is trained on a wide range of financial texts, market data, and reports, providing a deep understanding of financial concepts and trends.

- Adaptability: The RMC AI Advisor uses transfer learning to specialize in specific financial tasks, whether it's predicting market trends, optimizing portfolios, or managing risk, based on pre-learned generalized knowledge.

- Scalability: The foundation model enables the system to scale from individual client portfolios to larger institutional investment strategies without losing accuracy or efficiency.

- Natural Language Processing (NLP): The foundation model includes advanced NLP capabilities, enabling the AI to process financial news, research reports, and analyst opinions, and extract valuable insights.

- Multi-Task Learning: The model can simultaneously manage diverse financial tasks, such as forecasting, sentiment analysis, and risk management, ensuring comprehensive advisory.

- Contextual Understanding: By relying on foundation model frameworks, RMC AI can contextualize decisions based on real-time market movements and historical data trends.

- Personalization: The foundation model allows for the customization of recommendations by understanding individual financial goals and risk tolerances, making it adaptable to both institutional and personal finance scenarios.

- Continuous Learning: With its foundation model, the AI improves over time, constantly learning from new market data and trends, refining its advisory outputs.

- Interdisciplinary Insights: Beyond pure finance, the foundation model allows RMC AI to incorporate insights from other domains (e.g., global news, economics) to offer a more holistic financial analysis.

- Efficient Fine-Tuning: The foundation model can be easily fine-tuned to meet specific regulatory or market needs, ensuring compliance and accuracy in diverse financial environments.

By integrating a foundation model, the RMC AI Advisor for Finance gains robust analytical power, flexibility, and the ability to generalize and specialize in various aspects of financial advisory, making it a cutting-edge tool for the finance industry.

Technical Analysis in Real-Time

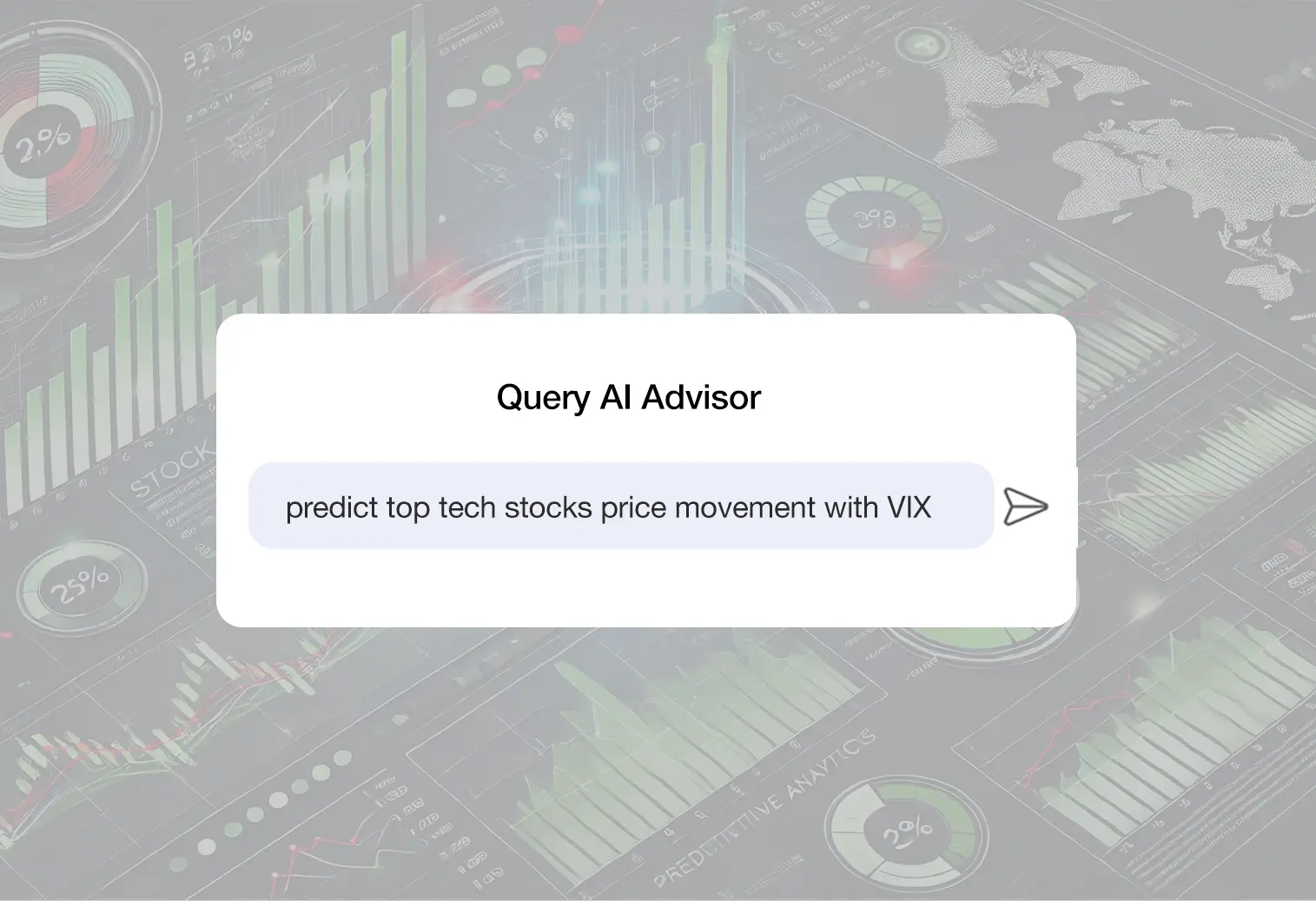

RMC AI excels in technical analysis, drawing on real-time market data to calculate critical metrics that inform trading decisions. The system continuously pulls data on stock prices, trading volumes, options data, and sentiment analysis. This live feed of information ensures that the AI is always working with the latest and most relevant data.

Technical indicators such as moving averages, the Relative Strength Index (RSI), and Bollinger Bands are calculated in real-time, allowing traders to see the market’s current state with up-to-the-second accuracy. Furthermore, RMC AI incorporates proprietary indexes like the Sentiment-Price Volatility Index (SPVI), the Fear-Greed Index, and individual stock Volatility Indexes (VIX). These indexes give an extra layer of analysis, combining market sentiment with traditional technical indicators to offer a more holistic view of the market.

The real-time capabilities of RMC AI mean that traders can react instantly to changes in the market, enabling them to adjust their strategies dynamically as new data flows in. The system’s speed and accuracy in processing technical metrics provide traders with a decisive edge in high-frequency or algorithmic trading environments, where every millisecond counts.

Ground Breaking AI Indexes

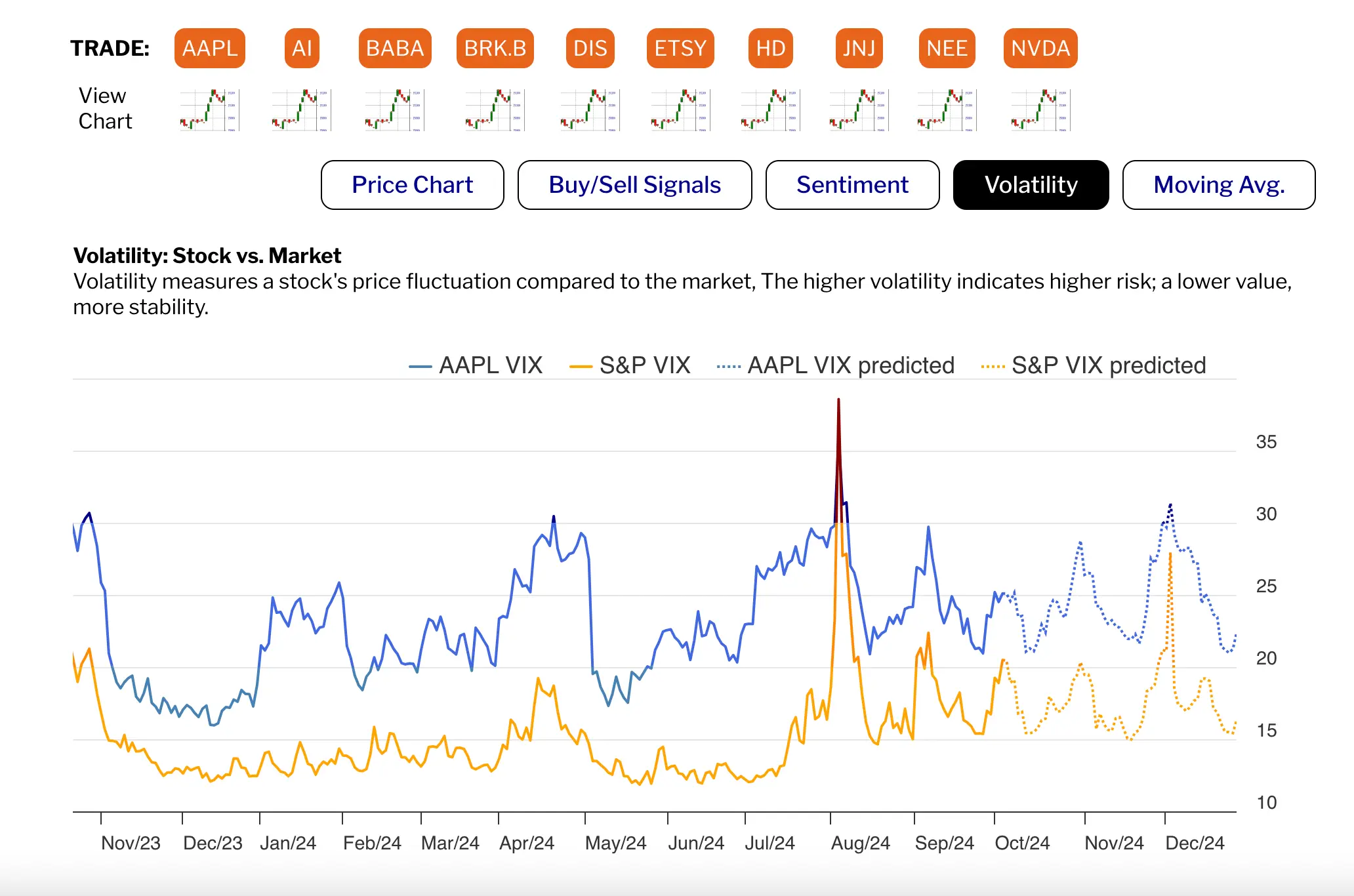

RMC's Stock-Level VIX

Unlike the traditional VIX, which measures the overall market volatility based on the S&P 500, RMC's Stock-Level VIX provides a unique volatility measure at the individual stock level. While the standard VIX reflects the market's expectation of volatility for the broader S&P 500 index, RMC's innovation breaks this down by assessing volatility expectations for specific stocks.

This stock-level VIX is calculated using the same principles as the traditional VIX—by analyzing the prices of options for a particular stock—but instead of looking at the entire index, it zooms in on individual stock volatility. This allows traders to assess not just general market conditions, but the specific volatility trends of individual companies, providing a more granular view of risk and potential price movements.

RMC's Stock-Level VIX is particularly valuable for identifying stocks that may be experiencing heightened volatility compared to the broader market, giving traders early warnings on potential price swings. This unique index offers insights that are not available through the traditional VIX or S&P 500-related volatility measures, enabling more precise risk management and decision-making for traders focused on individual stock movements rather than broad market trends.

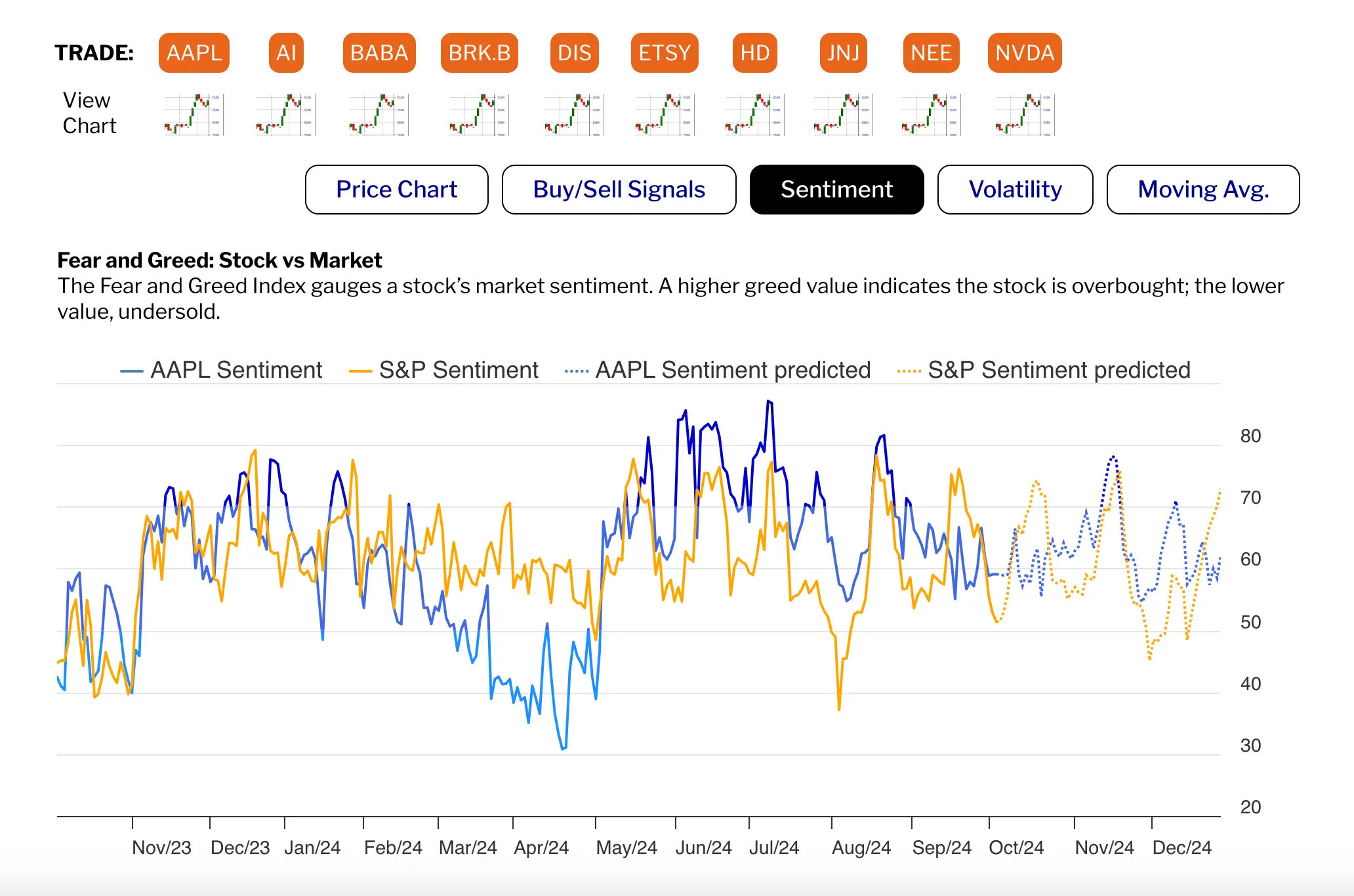

RMC’s Stock-Level Fear-Greed Index

Unlike traditional Fear-Greed indexes that typically assess market-wide sentiment, RMC's Stock-Level Fear-Greed Index is designed to measure sentiment on an individual stock basis, providing a more granular and targeted analysis. This index captures fear and greed metrics for specific stocks, in contrast to broader indices like the S&P 500.

RMC’s Fear-Greed Index analyzes a range of factors, including price movements, volume changes, volatility, and real-time sentiment data sourced from financial news, social media, and trading platforms. It evaluates these data points in the context of each stock, rather than just applying them to the broader market. This gives traders a more refined picture of the emotional forces driving a particular stock compared to general market sentiment.

By comparing the sentiment for a specific stock to the S&P 500, RMC's index allows traders to identify if a stock is experiencing heightened fear or greed relative to the overall market. This stock-specific focus enables investors to detect opportunities where sentiment around a stock deviates from market trends—helping to pinpoint potential buying or selling opportunities when emotions are overly pessimistic (fear) or overly optimistic (greed) for that stock.

This unique capability offers a groundbreaking level of insight, as it provides traders with sentiment analysis not just on a market index level but drilled down to the stock level, offering a sharper tool for making data-driven investment decisions.

RMC’s SPVI (Sentiment-Price Volatility Index)

The Sentiment-Price Volatility Index (SPVI) is RMC’s proprietary index developed to combine real-time sentiment data with price volatility information. Unlike traditional indexes that rely solely on price movements or volatility measures, the SPVI integrates social media sentiment, news sentiment, and public opinion into its analysis. By factoring in the emotions, perceptions, and biases of retail and institutional investors, SPVI offers a groundbreaking insight into how sentiment might influence stock prices.

The SPVI works by aggregating vast amounts of sentiment data from various platforms, including social media, financial news outlets, and sentiment tracking algorithms. This data is then weighted and correlated with price volatility measures to create a composite index that reflects both price action and the mood of the market. The innovative approach of SPVI is its ability to not only forecast volatility based on price trends but also capture emotional shifts in the market, making it a more holistic measure of risk.

Groundbreaking Data and Unique Insights

What sets tools like the SPVI apart is that its data and insights are typically not available as standalone data feeds. Traditional market data providers offer price feeds, technical indicators, and fundamental data, but sentiment-based indices like SPVI tap into less tangible yet highly impactful factors: how the collective mindset of the market participants may be driving price action.

Sentiment data is often difficult to quantify, but the SPVI’s integration of real-time emotional and psychological market inputs offers predictive insights that other volatility measures like the VIX or technical analyses cannot. By combining both technical and sentiment data, the SPVI captures a more nuanced picture of potential market movements, allowing traders and investors to anticipate shifts driven by emotion, rather than purely financial or technical factors. This makes it a groundbreaking tool, especially for traders looking to leverage psychological factors alongside traditional market data for a more comprehensive market analysis.

Since SPVI is built on proprietary algorithms that integrate real-time sentiment from diverse sources, it is not widely available as a public or commercial data feed. This exclusivity gives its users a competitive edge, as they are able to detect subtle shifts in market mood that could lead to significant price movements.

View RMC on Github to view how indexes are calculated

Automated Insights

RMC AI’s neural network is at the heart of RMC AI operates with a deep learning architecture that mimics the human brain’s ability to process data, recognize patterns, and adapt to new information. This neural network ingests vast amounts of both historical and real-time market data, identifying subtle patterns, correlations, and trends that would be difficult or impossible for traditional analysis methods to detect. The system continuously improves through machine learning, becoming more accurate as it processes more data.

By leveraging state-of-the-art deep learning models, RMC AI provides traders with powerful insights into stock volatility, potential risk factors, and probable future price movements. This AI capability enables not only reactive but proactive decision-making, where traders can anticipate market shifts before they occur. With its ability to "learn" from past market behavior and adapt to new data points, RMC AI acts as an evolving resource for traders seeking a competitive edge in fast-paced financial markets.

Neural Network

RMC uses a Long Short-Term Memory (LSTM) module, which is a type of neural network to forecast prices.

An LSTM is a special type of Recurrent Neural Network (RNN) designed to handle sequential data, and it is particularly effective at capturing long-range dependencies. The LSTM overcomes the vanishing gradient problem seen in traditional RNNs by introducing a memory cell and three gates: the input gate, forget gate, and output gate.

Here’s a brief explanation of how an LSTM works:

-

Memory Cell:

- The LSTM has a memory cell that maintains the information over time. It allows the network to retain important information and "forget" irrelevant details.

-

Gates:

- Forget Gate: Decides what information from the previous step should be discarded from the memory cell.

- Input Gate: Determines what new information should be added to the memory cell.

- Output Gate: Decides what part of the memory cell should be output at the current step.

- At each time step, the LSTM takes in the current input and the previous hidden state and memory cell state.

- The input, forget, and output gates then process these inputs to decide what information should be kept, updated, or outputted.

- The result is a new hidden state, which is passed to the next time step, and an output that can be used for predictions.

Smarter, Faster Trading Decisions

RMC AI’s ability to monitor the stock market in real-time is a critical advantage for traders who need to make quick decisions. The system continuously processes data across multiple metrics, including price movements, volumes, technical indicators, and market sentiment. By doing so, it can detect significant patterns and trends as they emerge, allowing traders to act quickly and decisively.

The AI tracks key metrics like changes in stock volatility, shifts in market sentiment, and the alignment of technical indicators such as moving averages or RSI. When these metrics hit predefined thresholds—such as a stock becoming oversold, a sudden spike in the Fear-Greed Index, or a volatility shift in the SPVI—the AI immediately triggers alerts. These alerts can be customized to the user’s specific preferences, ensuring that traders receive only the most relevant information.

This real-time alert system gives traders a significant edge, allowing them to respond to market changes as they happen. Whether it’s spotting an emerging buying opportunity or identifying a risk that needs to be mitigated, RMC AI helps traders make smarter, faster decisions that are based on data rather than emotion or guesswork.

Market Predictions with Machine Learning

At the core of RMC AI’s predictive power is its machine learning models, which are designed to make highly accurate forecasts of stock movements, volatility, and associated risks. Machine learning enables the AI to learn from past market behavior and adjust its models as new data becomes available, making the system smarter and more accurate over time.

The AI uses historical data to identify recurring patterns that often precede significant price movements. For example, it may recognize that a certain stock typically experiences increased volatility before earnings announcements. The AI factors in these recurring events when making predictions, allowing it to anticipate future market conditions more accurately.

As the AI processes more data, its predictive models become increasingly refined. This means that the AI not only predicts future stock movements but also assesses the level of risk associated with those movements. By providing traders with a forward-looking view of the market, RMC AI allows them to make more informed decisions, reduce risk exposure, and capitalize on emerging opportunities.

AI in Portfolio Optimization

AI has revolutionized portfolio management by enabling more precise and dynamic asset allocation. In traditional portfolio management, asset allocation is based on historical data and statistical models that attempt to balance risk and return. However, AI takes this a step further by continuously analyzing real-time data and adjusting allocations as market conditions evolve. The integration of AI allows for smarter, data-driven portfolio optimization, which can react to market shifts and uncover hidden opportunities or risks.

AI models use complex algorithms and machine learning techniques to identify the most efficient allocation of assets within a portfolio. By analyzing a vast array of data, including market trends, historical performance, and economic indicators, the AI can create more diversified and balanced portfolios tailored to specific risk tolerances and investment goals. The AI system does not just focus on maximizing returns, but also on managing risk, taking into account factors like volatility, liquidity, and correlations between different assets.

Back-Testing Analysis: Learning from the Past

One of the key components of AI-driven portfolio optimization is back-testing**. This process involves running a portfolio's asset allocation strategy on historical data to evaluate how it would have performed under various market conditions. AI systems can rapidly conduct back-testing on multiple strategies, comparing the results to identify the most effective approaches.

For instance, the AI might simulate a portfolio’s performance during past bull markets, bear markets, or during periods of high volatility. By analyzing the results, the AI identifies patterns and correlations that would have either optimized or hindered the portfolio's performance. Based on these findings, the AI can fine-tune its asset allocation strategies to improve resilience in future market conditions. This iterative process of testing, learning, and refining ensures that the AI is always working with the most up-to-date and relevant insights.

Furthermore, AI-driven back-testing goes beyond simple historical simulations. The AI can model hypothetical "what-if" scenarios, such as how the portfolio might have performed during past recessions or market shocks, and use this data to better prepare for similar events in the future. This ability to simulate various market conditions enables AI to optimize the portfolio not only for past trends but also for extreme scenarios, helping to mitigate risk in real-world investments.

In addition to back-testing, RMC AI allows traders to simulate various "what-if" scenarios. For example, they can test how their strategy would perform in high-volatility environments or during a bear market. This level of detailed analysis helps traders identify weaknesses in their strategies and adjust them accordingly, ultimately leading to more consistent and profitable performance.

Forward-Looking Predictions: Anticipating the Future

AI’s ability to optimize portfolio asset allocation is not just limited to historical analysis. By leveraging machine learning models, AI systems can make forward-looking predictions about future market conditions, helping to anticipate risks and opportunities before they arise. These predictions are based on a combination of real-time data, sentiment analysis, economic indicators, and technical factors.

For example, AI can identify emerging trends in financial markets, such as rising volatility in specific sectors, growing investor sentiment in certain industries, or macroeconomic shifts that could impact asset prices. By analyzing these data points, the AI generates predictive models that inform the portfolio’s future asset allocation. This means that instead of relying solely on historical performance, the AI is constantly adjusting the portfolio to reflect current market dynamics and potential future events.

These forward-looking predictions help investors to avoid asset classes that may underperform in the future and shift toward more promising opportunities. For example, if AI models predict that a particular sector will face headwinds due to economic downturns or regulatory changes, the system will automatically adjust the allocation by reducing exposure to that sector. Conversely, if the AI predicts growth in emerging markets or industries, it may increase exposure to capture those gains.

Continuous Learning and Adaptive Strategies

What truly sets AI apart from traditional portfolio management techniques is its ability to continuously learn and adapt. As new data flows in—from stock prices, economic reports, and real-time news events—the AI models adjust their algorithms to refine asset allocation strategies. This process is known as reinforcement learning, where the AI system improves its decisions over time based on the outcomes of previous allocations.

Because AI systems can process data at a speed and scale that human portfolio managers cannot, they can detect subtle market changes and respond almost instantly. As a result, portfolios managed by AI can be rebalanced in real-time, ensuring that allocations are always aligned with the latest market conditions. This adaptability is especially useful in volatile markets, where rapid adjustments to asset allocations are necessary to protect against downside risks or capitalize on emerging opportunities.

Automated Monitoring of Portfolio Allocations

Automated monitoring of portfolio allocations is a game-changing advancement in modern investment management, allowing portfolios to be consistently and accurately managed in real-time without requiring constant manual intervention. Through the use of sophisticated algorithms and AI systems, portfolio managers and investors can ensure that their portfolios remain aligned with their strategic goals, even as market conditions fluctuate. Automated monitoring goes beyond basic rebalancing, offering continuous oversight to detect discrepancies in asset allocations, manage risk, and identify opportunities to enhance returns.

At its core, automated monitoring involves tracking the performance and allocation of each asset in a portfolio relative to the target distribution set by the investor or portfolio manager. Traditional portfolio monitoring required regular manual reviews, where adjustments would be made based on quarterly or annual reviews. However, in today's fast-paced financial environment, these static approaches are no longer sufficient. Automated monitoring systems work around the clock, constantly evaluating how each asset class, sector, or individual stock performs in relation to the broader market. This allows the system to automatically detect when certain assets drift away from their intended allocation and take action to bring the portfolio back in line with its goals.

Dynamic Rebalancing and Risk Management

One of the most important aspects of automated monitoring is dynamic rebalancing recommendations. As market prices change, some assets in a portfolio may outperform or underperform relative to others, causing the portfolio to deviate from its original allocation targets. Automated systems detect these imbalances in real-time and can trigger rebalancing orders to ensure that the portfolio remains properly diversified and aligned with the investor’s risk tolerance and objectives.

For example, if an equity allocation increases beyond its target percentage due to strong stock market performance, the system might notify the need to sell some of the equity holdings and reinvest the proceeds in underweighted asset classes like bonds or cash. This helps to prevent the portfolio from becoming too risky by maintaining the intended asset allocation mix. Conversely, if an asset class underperforms, the system can buy more of that asset, taking advantage of lower prices to maintain the target allocation. This approach helps investors consistently "buy low and sell high" while keeping the portfolio in balance.

In addition to rebalancing, automated monitoring tools are highly effective in managing risk. Many systems are designed to continuously monitor market volatility, economic indicators, and other factors that may affect a portfolio’s risk profile. If the system detects that a portfolio is becoming too concentrated in risky assets due to market fluctuations, it can automatically reduce exposure to those assets. This real-time risk management ensures that portfolios stay within predefined risk parameters, even during periods of market turbulence.

Custom Alerts and Real-Time Notifications

Another key feature of automated portfolio monitoring is the ability to set custom alerts and receive real-time notifications about important changes in the portfolio. Investors and portfolio managers can define specific thresholds or conditions under which they want to be notified. For instance, if a particular stock falls below a certain price, if the portfolio's asset allocation drifts beyond a certain percentage, or if a specific sector shows signs of volatility, the system will automatically send alerts.

These notifications allow investors to stay informed without having to monitor the portfolio manually. In some cases, the system can also be programmed to trigger automatic trades when certain conditions are met, further reducing the need for manual intervention. This level of automation frees up time for investors and managers to focus on higher-level strategy and decision-making, while still maintaining full control over their portfolio.

Delivering Tailored Investment Strategies for Institutional Clients

RMC’s AI helps institutional managers deliver highly personalized and dynamic investment strategies tailored to their clients’ individual risk tolerance, time horizon, and financial objectives. By integrating advanced AI-driven insights with real-time data analysis, RMC AI Advisor provides institutional managers with the tools needed to manage client portfolios more effectively, ensure optimal asset allocation, and enhance decision-making across a diverse client base.

For risk-averse clients, RMC AI Advisor may recommend portfolios weighted toward low-volatility assets like bonds or conservative equities. In contrast, for clients with higher risk appetites, the system can dynamically adjust allocations to include more growth-oriented assets, such as technology stocks or alternative investments. The AI automatically monitors portfolio performance and adjusts risk exposure as needed, making it easier for institutional managers to manage a wide range of clients with varying risk preferences. This level of customization ensures that each portfolio remains aligned with client expectations, even in volatile market conditions.

Scalable, Data-Driven Customization

One of the most significant advantages that RMC AI Advisor offers is its ability to deliver scalable, data-driven customization. Managing the investment strategies of hundreds or even thousands of clients can be challenging, especially when each client has different financial objectives and risk profiles. RMC AI Advisor solves this problem by offering institutional managers the ability to automatically customize portfolios based on each client’s unique circumstances while maintaining the ability to manage these strategies across a large client base.

The AI’s ability to process vast amounts of data means that institutional managers can quickly scale their operations without sacrificing the personalized attention that clients expect. Whether managing small, individual portfolios or large institutional funds, RMC AI Advisor’s powerful algorithms provide a consistent, tailored experience for every client, ensuring their investments are aligned with their goals at all times.

Enhanced Client Engagement and Transparency

RMC AI Advisor also enhances client engagement and transparency, allowing institutional managers to build stronger relationships with their clients. The AI platform provides detailed reporting and insights into how each portfolio is performing, what adjustments have been made, and how these changes align with the client’s financial goals. This level of transparency helps clients better understand their investments and the strategies behind them.

Institutional managers can leverage RMC AI Advisor’s data to have more informed discussions with clients, presenting them with data-backed rationales for any portfolio adjustments or strategy shifts. This not only fosters trust and confidence but also allows managers to demonstrate their commitment to achieving the client’s financial objectives using cutting-edge technology.

Enhancing Efficiency and Scalability

For institutional investors and wealth managers handling large portfolios or managing multiple clients, automated portfolio monitoring provides significant efficiency and scalability. Monitoring dozens or even hundreds of portfolios manually is time-consuming and error-prone, especially in volatile markets where rapid adjustments may be necessary. Automated systems, however, can monitor thousands of portfolios simultaneously, providing real-time insights and rebalancing across all accounts as needed.

This automation reduces the operational burden on portfolio managers, allowing them to focus on strategic analysis and client communication, rather than spending time on the repetitive task of monitoring and rebalancing. Additionally, automated systems can provide consistent reporting, generating insights and summaries of portfolio performance and allocation changes on a regular basis. This transparency is particularly valuable for clients, who expect timely and accurate information about the status of their investments.

Automated monitoring of portfolio allocations brings significant benefits to both individual investors and institutional managers. It ensures that portfolios remain aligned with their long-term objectives, provides real-time risk management, reduces emotional bias, and enhances the efficiency of the portfolio management process. By leveraging AI and automation, investors can better navigate complex and fast-moving markets, ensuring their portfolios are optimized for both performance and risk management.

Enterprise Customization and Integration

RMC AI can be deployed as a white-label solution, allowing businesses to offer AI-driven stock analysis under their own brand. This means that brokers, trading platforms, and financial apps can leverage the powerful capabilities of RMC AI while maintaining their own branding and user interface. The AI’s advanced algorithms run behind the scenes, delivering real-time insights and analysis to end users without them knowing that a third-party AI system is powering it.

This white-label option allows businesses to enhance their product offerings, improve customer satisfaction, and stay competitive in a fast-moving financial landscape—all while keeping their brand identity intact.

Customization Options

One of the standout features of RMC AI is its high level of customization. Wealth managers and traders can design bespoke indexes and metrics that are tailored to the specific needs of their clients. This flexibility allows for a personalized approach to trading, where the metrics and alerts are aligned with the investor’s risk tolerance, investment goals, and market preferences.

View RMC on Github to learn more on how to use AI Advisor

For customized version of AI Advisor, contact us here at developer@redmatter.capital or developer@open-ai.finance

In addition, RMC AI supports dynamic metric adjustments. As client goals evolve, market conditions change, or new regulations come into play, the system can be easily updated to reflect these shifts. This adaptability ensures that RMC AI remains a valuable tool in a constantly changing market environment.

Seamless Integration through APIs

RMC AI is designed with flexibility in mind, allowing it to be seamlessly integrated into existing platforms and applications via APIs. Businesses can incorporate RMC AI’s advanced stock analysis and predictive capabilities directly into their own platforms, providing users with cutting-edge AI-driven insights without having to develop their own AI infrastructure.

The integration process is straightforward, enabling businesses to quickly enhance their service offerings with AI-powered tools. This is particularly valuable for brokers, financial platforms, and trading apps looking to differentiate themselves in a crowded market by offering AI-enhanced features.

Lower Costs, Free up Resources

RMC AI for enterprises offers a wide range of benefits by automating data processing and monitoring, freeing up significant internal resources. With RMC AI, repetitive and labor-intensive tasks are automated, allowing enterprises to streamline workflows and reduce human error. The system’s ability to process vast datasets quickly and accurately leads to faster decision-making and improved operational efficiency. By taking over these routine tasks, AI allows employees to shift focus toward more strategic initiatives, such as innovation, market expansion, and improving customer service, ultimately driving long-term growth and competitiveness.

Moreover, RMC AI enhances error reduction by continuously monitoring data streams, identifying anomalies, and providing actionable insights in real-time, which minimizes costly mistakes and optimizes performance across departments. This reliability in data management also improves compliance and reporting, as automated systems reduce the risk of manual input errors. The overall impact of integrating RMC AI is an organization that operates with greater agility, precision, and strategic focus, while also lowering operational costs and increasing scalability for future growth.