Learn More

Overview

Key points about Red Matter Capital platform:

- RMC is a regulated and licensed platform for issuing and trading digital securities for Pre-IPO companies, publicly listed stocks, commodities, and ETFs.

- Investors are able to purchase securities using crypto.

- Investors who purchase securities can stake synthetic tokens on DEX markets to earn money in multiple potential ways, including the stock position, trade commissions on DEX and the growth of a synthetic token price.

- Synthetic token prices are protected by the underlying asset price. When a token price decreases below the asset price, an investor is able to convert the synthetic back into the security, thereby maintaining a floor price for the token.

View an intro video

For Investors

Security tokens

About digital securities

A security is a negotiable financial instrument that holds some type of monetary value. It represents either an ownership position (e.g. shares) in a company, a creditor relationship represented by owning a debt obligation, or rights to a share of the company’s future revenues/profits.

Invest in Pre-IPO companies

Companies on Red Matter sell shares and securities directly to investors, cutting out investment banks and Wall Street middlemen. Typically, early-stage investors are limited to VC’s, brokers and banks, with individual investors unable to access potentially valuable deals. Red Matter allows individual investors to directly invest in companies they believe in.

Difference between crowdfunding and purchasing a security

Crowdfunding typically raises financing for new businesses in exchange for a product or service to be delivered in the future. Securities issued for a project provide the means for investors to receive a share of the project’s financial success, either through shares in the company or a share of revenues/profits.

Equity, revenue share and debt securities

A Pre-IPO company may issue three types of financial securities: equity, revenue share and debt. An equity-based security provides the investor with a number of non-voting shares in the company that owns the project. A revenue share security grants the investor, rights to a percentage of revenues that the company receives. A debt security is a loan for a fixed term and interest percentage that the company commits to pay to the investor when the obligation becomes due. A Debt security may be represented as a fixed income note or a convertible note where the investor is able to convert the note to shares at the date of maturity. Each of the different security types are transferrable and sellable to other investors on Red Matter’ secondary market exchange.

Selling Pre-IPO securities on a DEX markets

An investor may sell securities to another investor on Red Matter’s Primary Market exchange. Transactions on the exchange are executed by Blockchain smart contracts that enable peer to peer transactions. Additionally, if the Pre-IPO company issued a synthetic token, an investor is able to convert the security token into a synthetic token and trade it on a supported Decentralized Exchange to obtain liquidity and earn commissions when staked in a pool.

Listed financial securities

Buying publicly listed assets such as stocks and commodities

There are no restrictions for purchasing financial assets on Red Matter unless the account holder is domiciled in an OFAC country. For orders exceeding USD 5,000, Red Matter will request additional information on your personal details including ID, proof of residency and address.

Placing orders

When a buy order for a stock or commodity is created and paid for, the buyer receives a booking confirming your purchase and a status field on your order. When the status changed to ‘Filled’, it indicates the order was processed, indicating that the order was accepted.

Trading securities

After an order is filled, digital securities are issued on a Blockchain smart contract that are backed by the stock/commodity which was purchased. The digital securities are pegged 1 to 1 against the assets purchased, allowing to easily trade them on decentralized exchanges or investors in the crypto community.

Paying for financial securities

At this time, Red Matter accepts only USDT as a means of fast booking unless the investor proceeds to fund their account in advance with fiat.

USDT support for fast booking

Transfers on Blockchain smart contracts can be credited in seconds using crypto whereas fiat may take days to be received which makes the limit order price a buyer placed no longer valid by the time fiat is received. When Red Matter receives a USDT transfer, it converts to fiat, transfers the funds to the Red Matter broker account and executes the order within minutes.

Cashing out on financial securities

You can sell your financial securities by selling its security tokens on the Red Matter Primary Market Exchange or on the RMC DEX. You can also place a cash out request to Red Matter as a Sell Order, subject to terms and conditions.

View video

Trading Security Tokens

An investor may purchase a company’s securities, where the security represents the actual asset offered by the company, for example the company’s shares, property or inventory.

When trading the security token, RMC provides 2 exchanges:

- An over-the-counter (OTC) market with a Bid-Offer book

- A Decentralized Exchange for swapping and staking tokens

OTC Market

An over-the-counter (OTC) market is a decentralized market in which market participants trade stocks, commodities, currencies, or other instruments directly between two parties and without a central exchange or broker

Trading on OTC

To place a bid or ask order, tap on the dashboard Trade tab followed by the OTC button. If creating a Bid you are required to make a deposit equal to your Bid, usually an amount of crypto equivalent to your Bid price, using Meta Mask or other supported wallet.

Decentalized Exchange

Red Matter is the first of its type: a Decentralized Exchange (DEX) that exclusively trades securities and solves liquidity problems when trying to redeem small fractionalized units of assets in the form of tokens .

Instead of trading on an OTC market, where larger orders are placed and counter party settlement risks exist, Red Matter traders transact through am AMM’s (automated market maker) liquidity pool that pairs security tokens with a stable coin.

DEX markets like Uniswap and PancakeSwap have attracted large communities. However, none of the DEX markets trade any tokenized securities backed by real world assets and with the exception of a few tokens, traded tokens have little intrinsic value.

Red Matter proposes a new type of DEX, where tokens are listed securities (for example sovereign bond tokens) and where the liquidity problems that prevent the growth and adoption of digital assets are solved.

Trading on DEX

Click on the Swap tab to open the UI to buy or sell a security token with USDT or other crypto that has been paired with the security token. The video below demonstrates how this is done.

Staking and Withdrawing tokens on DEX

Liquidity pool providers can stake their security tokens and earn commission fees on their asset. Staking risks and impermanent loss are significantly reduced, as tokens can be withdrawn and redeemed at any time against the ‘real world’ asset value.

When staking on DEX, security tokens are linked to the actual underlying asset and that is reflected by the token price on DEX. No matter what the DEX trading price for the token, LPs are able to withdraw their tokens and sell them by placing a sell order or via the OTC desk as an Ask offer.

The video below demonstrates how staking is done.

At the time when tokens are withdrawn, trade commissions from Swap trade spreads are distributed to an LP participant in amounts of the pairs traded (e.g. USDT-Apple token). LPs receive trade commission earnings which are given as a % of the pool owned by the LP.

The video below demonstrates how withdrawing is done.

Earning Fees as a Liquidity Pool Provider

Red Matter charges a flat 0.3% fee per trade. The fee goes to the liquidity providers, and this is to reward people for their liquidity. The protocol can also trigger a change that would give 0.05% to Red Matter, and that part of the fee would be discounted from the LPs instead of the traders.

Trading fees and costs

Buying Pre-IPO securities

When purchasing Pre-IPO security tokens, the costs are paid for by the project issuer. If you pay in a different currency than the project currency, you receive the amount of securities after converting into the issuer’s currency.

Trading securities on the Red Matter OTC Market

When trading security tokens on the Red Matter OTC Market, sellers pay a 1% commission on the sale to Red Matter.

Trading on Decentralized (DEX) Exchange

When trading or swapping tokens on RMC’s DEX, traders pay a 0.3% commission fee paid directly to the liquidity pool. This fee is split by liquidity providers proportional to their contribution to liquidity reserves.

Fees are deposited into the liquidity pool and increases the value of liquidity pool tokens.

When withdrawing tokens back onto RMC for token sale on the OTC or for placing a Sell order to RMC, traders pay a 0.25% commission to Red Matter.

Trading fees for public securities

When buying or selling securities (stocks, ETFs, bonds, commodities) that are traded on a publicly listed exchange, the following commission fees apply to your order depending on how you pay for the security.

There are 2 fees applied which are on a per transaction basis:

- USDT conversion fee: 0.25% of the Trade Value

- Trade commission fee: USD 0.005 per share with a minimum of USD 1 per order and a maximum of 1% of the Trade Value.

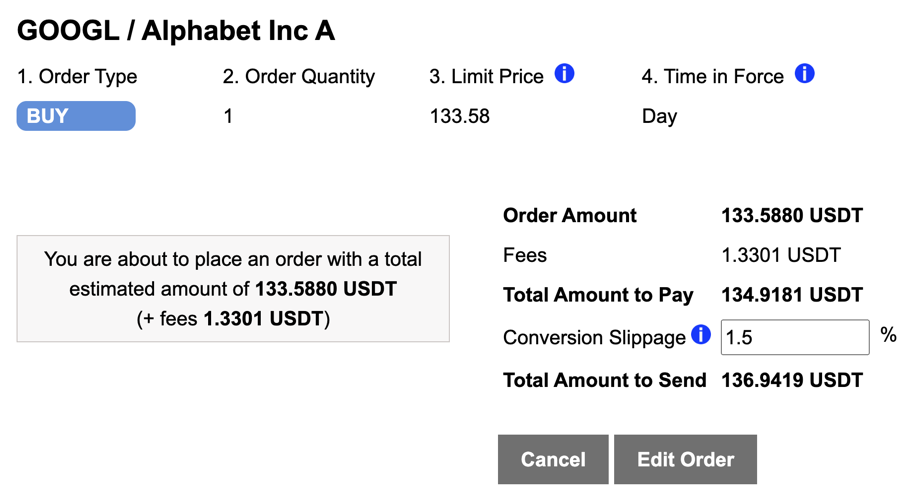

Here is an example of a sample trade when:

- You intend to submit an order to buy 1 Alphabet shares at the price of 133.588 USD per share, total Trade Value of $133.588

- Conversion fee = $0.33

- Trade fee of minimum $1 per trade = $1.00

- Your total fees on this trade example are = 1.33 USD

Note: the above example does not account for any credit card payment fees that maybe charged by Banxa or gas fees when sending USDT over the Polygon network.

Management Fees

There are no management fees for trading on Red Matter.

Placing and Booking Orders

Purchasing a Listed Security

Preparing an Order

When placing an order for a listed security you are presented with fields for Quantity, the Limit Price and Validity Date.

- Quantity is number of shares you wish to buy or sell.

- Limit Price is the maximum price you agree to pay for a share of the security.

- Time in Force is the time period that your order can be execute, either Good Till Cancel, Immediate or Day.

After entering those fields, you are placing an order at a maximum price within a valid time period. We suggest increasing the Limit Price to account for market volatility. Amounts paid over the purchase price will show as a credit on your account and can be used for another order.

The order form indicates the amount of USDT you need to pay to place your order. The amount is calculated to include a real time conversion of USDT to fiat (normally USD) and trade fees.

Submitting an Order

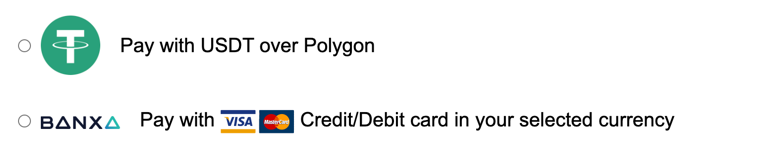

When submitting your order the payment form will display the amount of USDT you need to pay, along with the following payment options:

- Pay to a Polygon wallet address

- Pay via credit card using Banxa

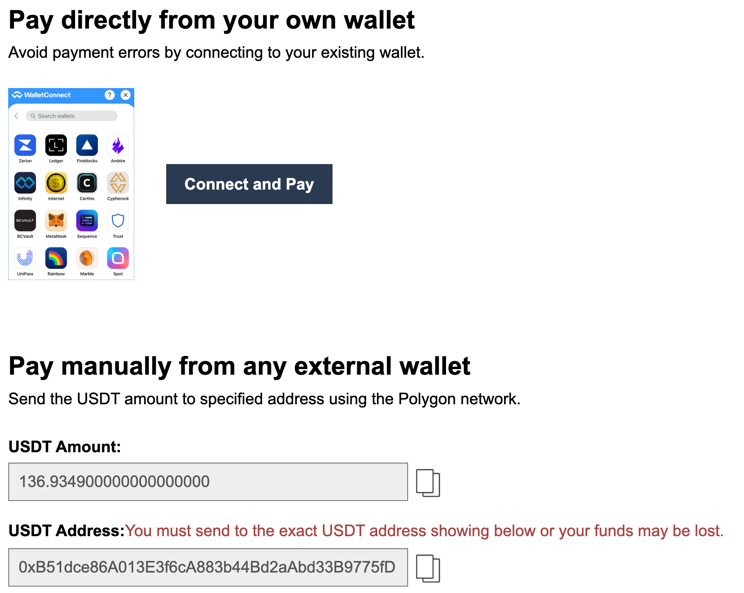

Paying to a Polygon address

Sending USDT maybe done seamlessly via a 3rd party wallet application (e.g. MetaMask, TrustWallet) where you have USDT.

You may also manually send USDT to the wallet address displayed on the payment instructions (each order has a unique wallet address that is generated).

Order Status Tracking

Your order status is displayed under the Trade tab and the Orders list on your dashboard.

The status fields on your order track indicate the different possible stages of your order:

- ‘Waiting for payment’ when your payment is being confirmed on the Blockain before crediting your account.

- ‘Processing’ when funds are being converted and sent to your account.

- ‘Pending’ when your order has been placed.

- ‘Filled’ when your purchase has been executed.

- ‘Insufficient funds’ when the amount of funds received is less than the Limit Price you set.

- ‘Expired’ when your order was not filled within the Validity Date due to market volatility.

Waiting for payment

This shows when your payment is being confirmed on the Blockain before crediting your account. Normally takes less than 1 minute.

Processing

This shows your LTC payment was confirmed on Blockchain and is being converted into the asset’s fiat currency and thereafter transferred to your account for booking your order. This may take up to 30 minutes in certain conditions.

Pending

When your order Limit Price is less than the current market price, your order will remain Pending until the market prices adjust or you hit the Cancel button to re-book a new order.

Filled

Filled means your purchase has been executed. You are issued security tokens against the asset you purchased which you can find on your dashboard under the Holdings tab.

Insufficient funds

This indicates the amount of funds received after the LTC was converted to fiat is less than the Limit Price you set. You are able to re-book your order and the amount you have previously sent shows up as a credit on your account that is applied to your new order.

Expired

This happens when your order was not filled within the Validity Date due to market volatility. You may re-book your order with a new Limit Price.

Purchasing a Pre-IPO Security

Preparing an Order

To invest in a pre-IPO company, hit the Invest button to open the form where you fill in for the amount of securities you are purchasing. The amount of security tokens you will receive is automatically calculated and displayed along with the amount to pay and the currency of the securities.

Submitting and Paying for an Order

When submitting your order the payment form will display the amount and currency to pay. In case of a fiat payment the options include Credit Card, SWIFT and SEPA for fiat required transactions. If the securities price is denominated in crypto, you are presented with the crypto amount you need to send along with the unique wallet address for this order.

Order Status Tracking

After paying for an order, the status field indicates ‘Waiting for Payment’ until your funds are received and then changes to ‘Purchased’. The time for receiving funds varies depending between 1 to 3 days depending on the type of transfer.

For Company Issuers

Issuing a Security Token

A company can issue a security token against an asset that is registered on Red Matter and sell tokens for fiat or cypto.

Assets that can be registered on Red Matter include:

- Shares in a Pre-IPO company

- Real estate, property

- Media and digital content

- Metals and agro commodities

- Accounts receivable, stocks (inventory)

- Collectibles

Listing a project

Listing involves setting up a project based on the type of asset backed security to be issued.

There are 2 parts for creating a listing:

- Registering a project

- Creating an investment offer

Part 1 requires the company to fill out information on the company project, upload content and provide a list of team members.

Part 2 requires providing details and legal information on the company, the asset, type of investment offer, asset valuation and the amount of funding to be raised.

After registering yourself as a company looking to raise funds, you are able to create a project by logging into your dashboard and clicking the button ‘Add Project’ located under the Projects tab.

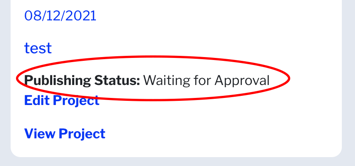

Part 1: obtaining project approval

After submitting Part 1 of your project, the Red Matter compliance team will review the information provided. The status is ‘Waiting for Approval’.

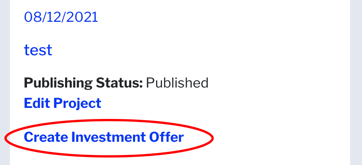

If approved, the company is allowed to then create an investment offer. When receiving approval, you will receivean approval notification and the ‘Create Investment Offer’ button appears.

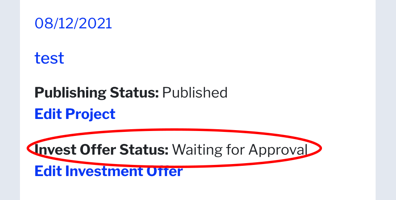

Part 2: obtaining investment offer approval

Click on the ‘Create Investment Offer’ button to proceed to provide the details of your offer and for the issuing of your security token,

When you Save your investment offer after carefully reviewing it, the Red Matter compliance team will review the asset backed investment offer information provided. The Invest Offer status is ‘Waiting for Approval’. While the offer is under review, you are able to Edit your offer.

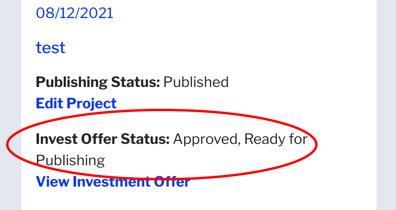

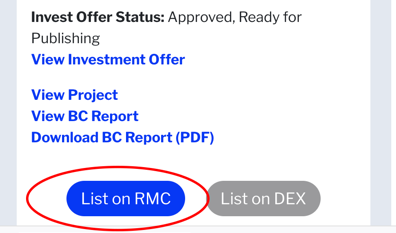

If approved, the company is allowed to then issue its token for investors to purchase. The Invest Offer status is ‘Approved, Ready for Publishing’. After the offer is approved, you are unable thereafter to Edit your offer without submitting a request from the compliance team.

Note: the compliance may request additional information from the company issuer at any stage during the listing process.

Listing your Security Token

After receiving approval of your investment offer, you are able to list your project tokens on Red Matter’s centralized exchange by clicking on the ‘List on RMC’ button.

You may also choose to list your tokens on a decentralized exchange (Pancake Swap) by clicking on the ‘List on DEX’ button. To know more on how DEX trading works, review the investor section ‘Trading Tokens on Markets’

Marketing Security Tokens

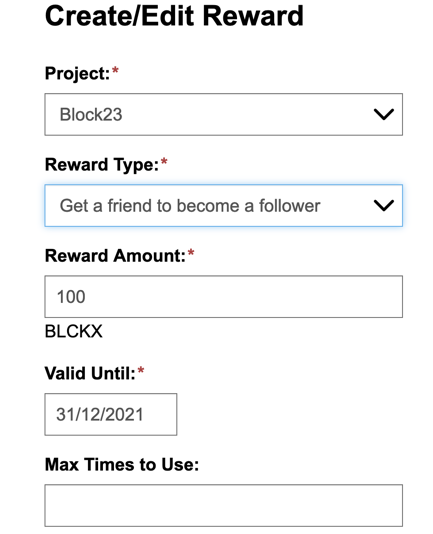

Company-issuers can use Red Matter’s marketing tools to give reward tokens to followers in exchange for actions that help promote your project. For example, a follower may write a review, post a story or provide referrals that help to build a following. In return for those actions, the fan receives free reward tokens. Reward tokens are stored in an encrypted wallet that is provided to both the fan and project owner.

Reward Tokens

Projects can offer rewards in the form of vouchers that are priced in tokens. For example, an issuer may give a discount on your securities in exchange for reward tokens. The reward possibilities are limited only by your creative thinking.

To issue rewards, go to your issuer dashboard and click on the tab ‘Rewards’, followed by the ‘Add Reward’ button. Create your reward by selecting the Reward type and amount of tokens to be offered

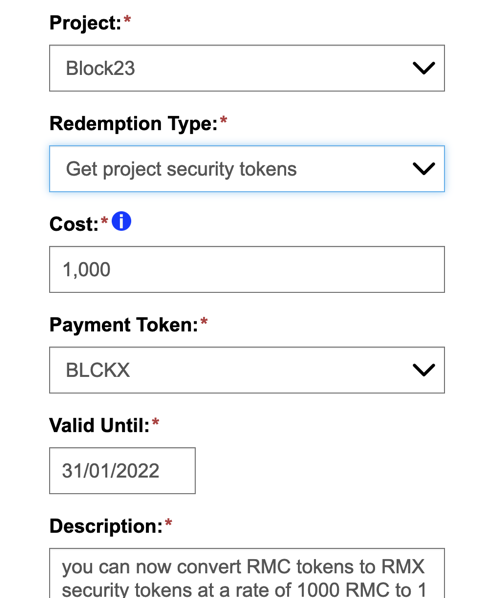

Reward Token Vouchers

Followers can spend their reward tokens when you create a Voucher. To create a voucher, click the button ‘Add Voucher’ and select the Voucher Type.

Enter the voucher cost to the follower in the amount of tokens (Cost) and the method of payment (Payment Token). The payment token is the reward tokens earned by a follower or you can select Litecoin LTC in case you want your voucher to be purchased).

Creating a News Feed

Potential investors are able to follow your project by subscribing to your news feed. To create your news feed, click on the tab ‘Marketing’ and the ‘Add News’ button, Followers of your project will receive your news feed on their dashboards and email and be encouraged to invest as your project progresses and deals are made.