Why Millennial investors and tech are changing how markets work

Tech-savvy millennials have been exhibiting an appetite for making their own decisions and choices on where to invest their money, a very different approach than that of their parents who heavily relied on personal relationships with their investment broker or banker.

Given the level of access to financial information on companies and markets, all it takes are a few clicks on an app for millennials to undertake some research on a company, review a prospectus, get advice and commit funds.

Other indicators support the idea of a radically different approach to investing:

- Millennials comprised 57% of the consumers buying cryptocurrency in 2020

- The average age of a Robinhood user is only 28 , 78% are under age 35

- Factors such as social responsibility and environmental responsibility play a key role in where money is invested

- More than 30% of millennials are more loyal to brands that are technology focused.

Millennial locked out of pre-IPO, private markets

Examining the price growth curve of highly successful listed companies, its easy to see why direct investments into pre-IPO companies would fit into the millennial investor’s approach and interest areas.

Typically, a slow price growth between Year 4 and Year 1 is followed by an X times price increase in the 12 months prior to an IPO listing and opening day trades.

Let’s take a look at an example: Slack, the popular business collaboration application went public in 2019. Slack’s stock was valued at $11.91 per share in the last VC funding round 2018. In less than a year, Slack’s shares after IPO opened at $38.5 per share or 225% above the last private funding in the prior 10 months period.

The typical case seen with Slack and other unicorns is explained by the fact that a private pre-IPO market was held by the founders and early-stage investors using offline brokers and investment banks that resulted in pre-IPO trading activity ahead of the actual listing. Moreover, the level of activity directly co-relates to the anticipated listing time and forecasted opening day pricing, thereby explaining the fast run up in prices only months before, as exhibited on the chart below.

Moreover, the level of activity directly co-relates to the anticipated listing time and forecasted opening day pricing, thereby explaining the fast run up in prices only months before, as exhibited on the chart below.

As much as millennials would be likely to participate in a pre-IPO market, they are locked out as investors are limited to accredited investors (in most cases) and large transaction sizes (several million at minimum), thereby restricting the market to wealthy and institutional investors.

Between the time of the private market close and opening day trades, marketing noise usually gets applied to pump up the prices, arguably at the expense of the retail investor. As a case in point, shares of Airbnb originally priced at $68 prior to listing, opened trading at $146 per share but closed the day at $144.71.

The above examples are not the only factor why 86% of Millennials said they distrust Wall Street but it’s a good example. As Elizabeth Warren states: ‘It’s not about protecting people from making bad trades. It’s about keeping the playing field level…Wall Street is a rigged game’.

Democratizing investments via a public pre-IPO market

The SEC would state that securities laws are designed to protect the individual, non-professional investor from investing into companies who haven’t filed a prospectus with the SEC. However, those same laws are used by Wall Street to take advantage of retail investors.

Democratizing the pre-IPO market would need a large re-think of current regulatory frame works in order to allow retail investors to purchase and trade in early-stage companies. An additional problem for regulatory agencies is that technology is evolving faster than their ability to keep up, as exemplified by crypto currency markets, new asset backed tokens such as NFT tokens and products built on decentralized Blockchain applications.

Although there are existing platforms presenting pre-IPO investment opportunities, the limitations for accepting only accredited investors from specific countries of residence and without a secondary market — all put up serious obstacles for investing into the next unicorn.

Fractional investing: digital securities on Blockchain

To realistically implement a public market for pre-IPO companies that supports fractional investing , the technical issue of how to settle small volume trades at a low cost is a big issue.

However, innovative Blockchain marketplaces provide a solution via decentralized peer to peer trading where fractionalized trading is fully automated and executed at virtually zero cost using Ethereum smart contracts:

- Shares or other company assets are registered on Blockchain

- Investment security terms entered off chain are uploaded to a smart contract

- Digital security tokens, backed by the shares on the physical company registry, are issued

- Buyers purchase any amount of asset backed tokens representing the underlying asset (e.g. (e.g. a fractional share)

- Payments are made by credit card or crypto for real time transfer of tokens to a buyer’s wallet

- Buyers and Sellers can trade tokens on the secondary market without any restriction

New regulatory environment: investments for everyone, anywhere

Regulatory agencies are reluctant to adopt new regulations markets that support technological innovations such as trading digital securities.

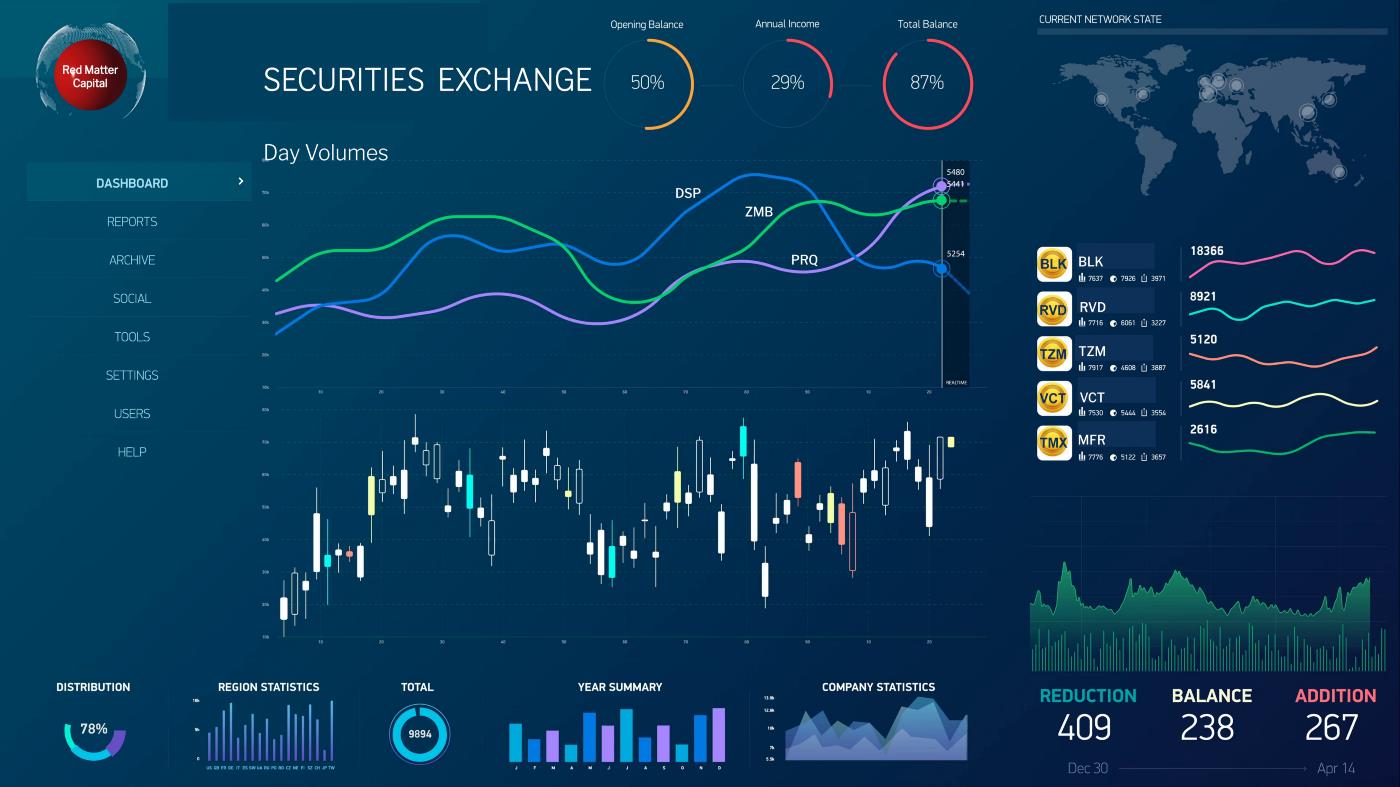

However, new capital markets like Montenegro (the small Balkan country that borders the EU) are embracing the potential. Recently, the Capital Markets Authority of Montenegro (the equivalent of the SEC) has provided a license to Red Matter Capital to issue digital securities for companies from any domicile and to allow investors (including retail) to purchase and trade asset backed token on a secondary market.

The Red Matter Capital platform is a good example of how private capital can be more efficiently raised when connecting issuers directly with followers who support innovation and believe in the value of a company.

Technology will eventually level the playing field, allowing millennials and future generations of investors to directly participate in the success story of companies that represent their values and interests.

If you are an investor or company interested in digital securities and want more information on Red Matter Capital, please free to reach out to me at info@redmatter.capital. Sign up early to get a free account at https://www.redmatter.capital .