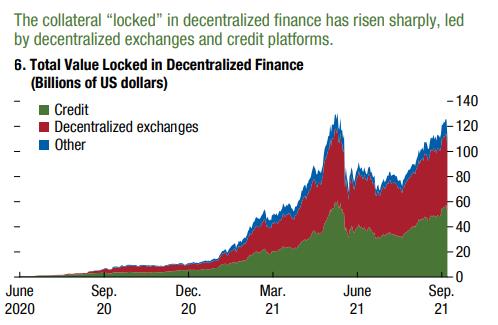

Technological innovation is ushering in a new era of payment that is more accessible and flows across borders swiftly. Decentralized finance grew from $15 billion at the end of 2020 to about $110 billion in 2021. Digital Securities have received a lot of attention recently! In fact, global investors are paving the way for STOs as a mainstream form of financing.

Meanwhile, the Decentralized exchanges are focusing on developing new issuance solutions to optimize the most of blockchain and digital security token. Issuance and exchange of digital assets are technically accessible for everyone, and all other aspects of the lifecycle have been neglected. Decentralized exchanges are creating blocks of the DeFi (decentralized finance) ecosystem. Users now trade crypto directly without using an intermediary. The need for a credit risk evaluation has been eliminated. Read on to seek a detailed analysis:

Potential DEXs Finance

DEX investors place new asset-backed tokens against crypto assets. The objective is to enter and exit the process at a higher exchange price. In certain cases, an annualized percentage on stable coins is obtained, 10X or more than fat deposits. Staking digital assets on a smart contract that conducts new tokens offers high liquidity and influences the protocol by receiving transaction fees.

Decentralized exchanges are non-regulated, and hence SEC may take action against current regulations that attract investors with the promise of returns. Some DEXs use borderline practices interpreted by the SEC as violating securities laws. DEX validated the concept of decentralized tokenization platforms where crypto investors create liquidity pools for new tokens and swap them with listed cryptocurrencies.

Transformative Impact on Investment & Beyond

Popular DEX investing method accounts for a 3% market share in the crypto-finance space. The cryptocurrency world promises to make money universally accessible to everyone globally. At the same time, Decentralized Finance (DeFi) takes that promise a step further. The decentralized world is different from everything we have ever seen before. Investors who need robust training in a volatile market must invest in DeFi protocols. The growth of decentralized finance is stumbling, with a market cap hitting close to $100 billion this year and the important aspect of this growth is decentralized exchanges (DEX). They manage liquidity and execute trades with smart contracts. It removes the need to rely on central authorities and intermediaries for a peer-to-peer trading environment.

What’s next for DeFi?

Finance has always been in one form or another since the birth of human civilization. The digital security token is the latest financial service that we use in today’s fiat system. The world has already seen asset issuance, exchange, borrowing, lending, and so much built-in crypto space. So, what's next!

The generation relies on collateral as a safeguard; you need to own crypto in order to borrow more crypto. However, traditional borrowing and lending will need to rely on an identity system, unlike today's credit systems. A universal decentralized identity that seeks privacy can be seen as an innovation in space. However, the black swan for DeFi is a smart contract vulnerability. Millions of dollars could be drained instantly if a bug or hack exploits an open source.

Choosing DEX Signifies:

Greater Access- No user data is required to trade on DEX, but a public address is needed before starting the process. So you are not subject to any interference done by a central entity. As a result, DEX represents a more inclusive and equitable ecosystem. The ‘non-custodial' process also lets DEX users access their private keys.

Secure Exchanges- CEX users cannot control private keys and can be attacked. One of the biggest examples was BitMEX being hacked in December 2020. DEX seems to sidestep this risk by offering trades through smart contracts without having to be passed through an intermediary third party.

Better Privacy- Data leakage is on top of every investor's mind! DEX doesn't need you to provide sensitive personal details to third parties while registering for exchange. Everything is logged, traceable and transparent. Trading on CEX occurs off-chain in local databases, which means there is no proof that someone bought something at a given price. Well, this can’t happen on DEX.

Reliability- DEX is a more reliable option that has no centralized entities with total control. They can simply shut down trading when the market crashes or when a number of users liquidate their assets. However, with growing technology, there is still room for improvement.

But how is RedMatter Capital unique?

This platform is completely regulated under Montenegro’s Capital Markets Authority license. Users can issue and trade asset-backed security tokens on DEXs. In addition, RedMatter invites issuers to create digital security token by physical and digital assets to trade on DEX marketplaces.

RedMatter Capital Mechanics

RMC (RedMatter Capital) private Ethereum based digital securities are converted into BSC (Binance Smart Chain) Tokens listed on decentralized exchanges. BSC is preferred over Ethereum due to its lower cost and high speed of transactions. Here is step-to-step guideline for your convenience:

- First of all, issuers register security such as equity, debt, revenue share, etc., on RMC. Let's name the asset backed tokens of RMC private Ethereum ERC 20 type ’BLCK.’ Now, assume BLCK tokens are purchased at 1 USDT. The primary market offering securities of the issuer are priced in fiat or stable coin.

- After that, the issuer can convert BLCK tokens into BSC tokens at one conversion rate. For example, let us say that the converted BSC token ‘BLCK X’ is a BEP 20 type token. So, 1 USDT purchase 1 BLCK X token.

- A new Binance Smart Chain Contract is generated while issuing the BLCK X tokens. Now it can be paired to a BSC cryptocurrency such as XRP, LTC, BNB, or others listed on DEX. For example, 500 BLCK X will be traded for 1 BNB on crypto exchanges.

- Issuer stakes BLCK X tokens into a liquidity pool against the valued amount of BNB tokens to Automated Market Maker (AMM).

- DEX for supporting trading liquidity. BLCK X is airdropped to identified major liquidity providers. DEX traders can buy and trade BLCK X for BNB tokens in their wallets.

Digital Security Token: A Boon for Digital Era

The idea of denominating fractional ownership of a real asset in digital security tokens is more structured. Investors can see if the ownership stake is preserved on the blockchain ledger. A security token is a bridge between the traditional finance sector and blockchain. Assets divide up through tokens that exist in the traditional market like equities (either public or private equity) or real estate. Many platforms directly undercut ICO models by tokenizing equity rights for pre-IPO companies.

Utility tokens have been restricted, and companies raising capital can circumvent institutional finance and the costs involved. The volatility of the crypto market has become riskier to launch an ICO and expect stability to run a company. Many projects take cash out immediately to remain solvent. ICO participants are “investors,” opening doors to new ideas.

In A Nutshell

RedMatter is the first-ever DEX smart contract to trade BSC tokens backed by digital securities against crypto. We provide a new way to invest assets safely. While DEXs are ahead in the market, DEX 2.0 brings together both traditional and crypto investors to trade in tokenized physical assets. Our Proof of Asset protocol registers assets on smart contracts, and asset-backed security tokens are traded on decentralized exchanges. Talk to our experts today and learn more about the process!