Smart Investing with AI - No Account Pre-Funding

Smart Investing with AI No Account Pre-Funding

Your AI Personal Advisor

The Advisor leverages AI to analyze large data sets, creates investment strategies and portfolios with real time market insights, forecasts investment opportunities and risks - enabling informed decisions.

Investing Made Simple

We harness the power of Blockchain to execute orders swiftly, eliminating

the need for setting up a traditional broker account. Register, click to Trade a product, pay with stablecoin

and smart contracts do the rest.

High Returns from Dividend Stocks - up to 15%

Benefit from both income and growth potential when investing in stocks that pay out strong dividends. Invest with ease by conveniently purchasing and selling stocks via your crypto wallet, with dividends paid out in UDST, ensuring a hassle-free and secure transaction process.

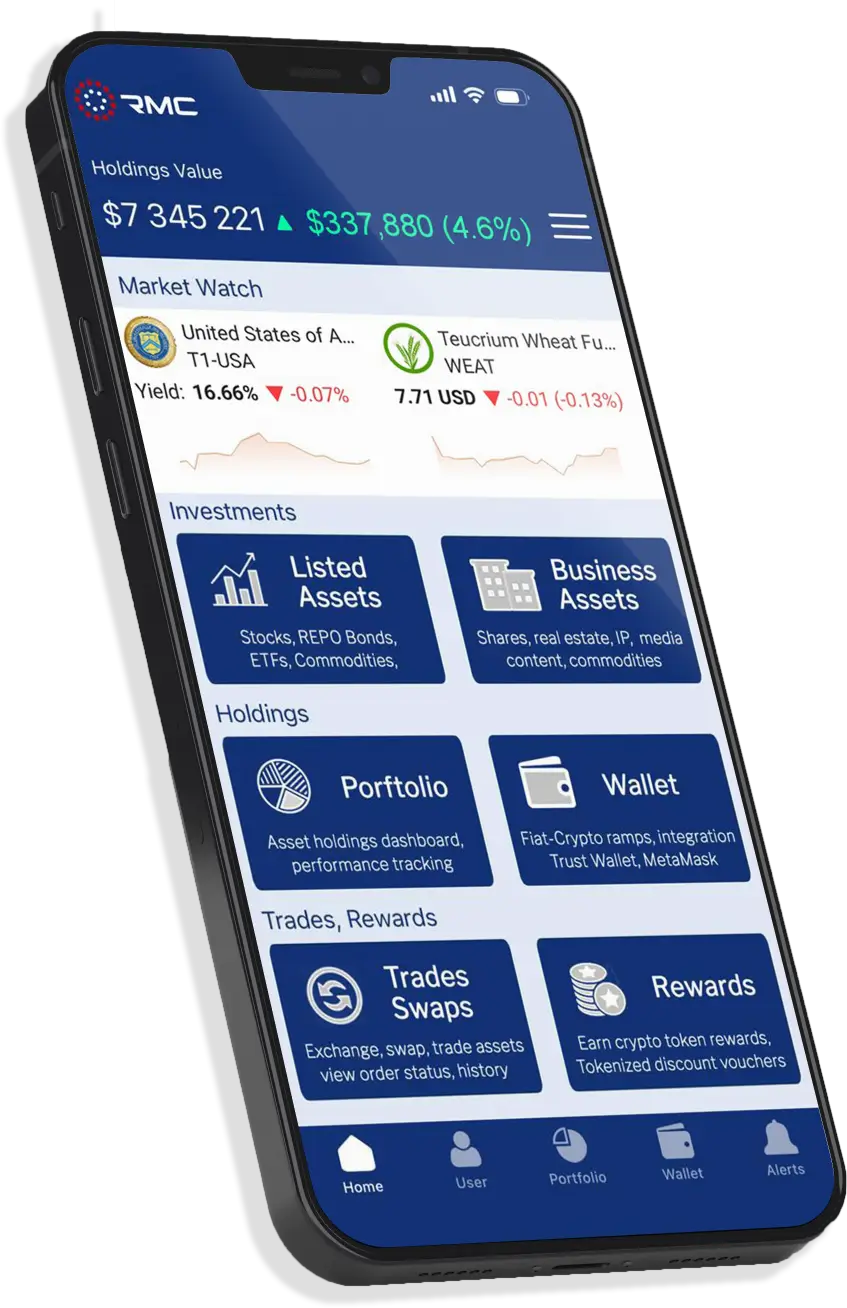

Trade Anytime, Anywhere

Trade leading stocks, bonds, commodities, funds, and private assets, wherever you are. Enjoy the flexibility of fractional trading at the lowest costs with absolutely no hidden fees.

Safeguard Your Savings

Shield your savings from the impact of local economic inflation. Convert funds held in local currencies into Grade A investment products and commodities that are denominated in major global currencies, as a hedge against devaluation.

Invest Like a Pro

Diversify your portfolio and manage risks effectively. Gain exclusive access to government and corporate bonds, funds, and ETFs – opportunities typically beyond the reach of small investors.

Efficiency Meets Innovation

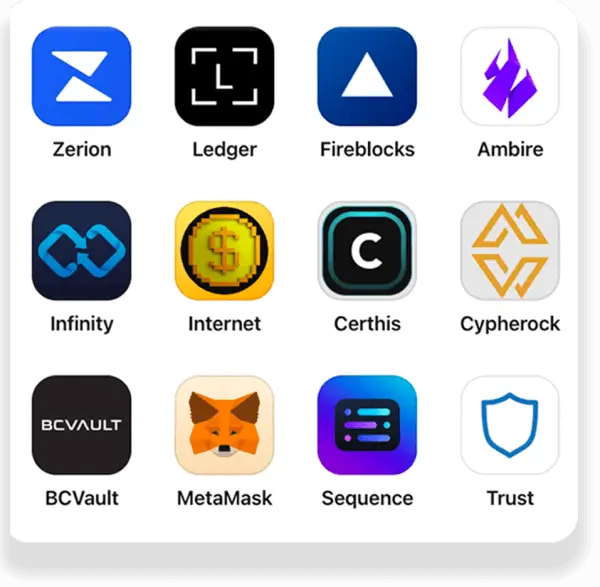

We're at the forefront of financial technology, bringing you the latest in blockchain advancements. Link your existing blockchain wallet or use Red Matter's wallet for added convenience. Explore a wide range of assets and start trading immediately. No waiting, no fuss.

DeFi Securities Trading

We unlock the power of blockchain technology to tokenize securities, revolutionizing the way you trade. Experience 24/7, secure, and efficient trading on our Decentralized Exchange with transactions recorded on the blockchain, providing an immutable record of your securities ownership and trades. Rest easy knowing your investments are protected by encrypted smart contracts, and enjoy exclusive access to your wallet for added security. Embrace the future of finance with regulated DeFi trading of tokenized securities.

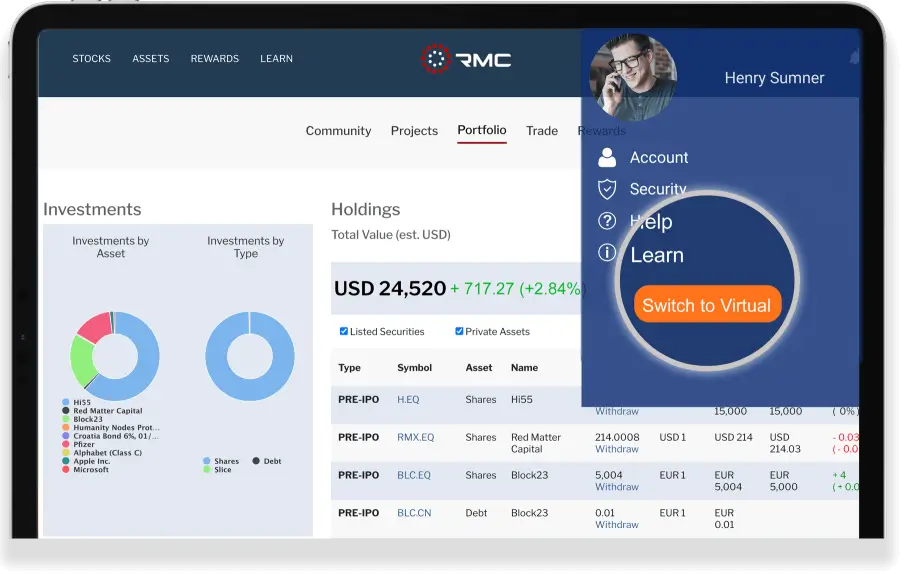

Experience Risk-Free Trading

Every new account on RMC comes with a $100,000 credit in a Virtual Portfolio. Practice and trade across all the financial markets RMC offers in real time. When you're ready, switch to Live Trading with a single click

Investing Opportunities for Everyone

Seamless portfolio management and live trading integrated with leading wallets and payment systems, enjoy rewards, real-time market watch, and much more.

-

-

Watch out for @redmatter the democratisation of equity markets. It’s about time that buying, holding and selling shares to become as easy as buying a cup of coffee. This is an exciting way to completely change how companies can raise capital in a digital world!

David Brown, CEO, Hi Group

-

Red Matter connects Blockchain and DeFi to the real investment world via asset backed digital tokens, benefiting especially innovative start-ups in areas like clean tech and delivering more efficient financial services.

Alex Borissov, CEO Finaport Singapore

-

We look forward to Red Matter Capital, licensed by the Capital Markets Authority, contributing to the development of Montenegro’s CRYPTO ECONOMY.

Marjan Juncaj, City Manager, Podgorica, capital Montenegro

-

Montenegro’s the NEW MONACO of Europe. It has one of the most attractive tax rates in Europe, emerging as a luxury destination, with some calling it "the next French Riviera”.